Solarbeam Eclipse: Here’s how you can participate

Understanding IDOs and their risks with a step by step guide on how to participate in Solarbeam Eclipse

Disclaimer: This content is for informational purposes only and you should not make decisions based solely on it. This is not investment advice. Investing in IDOs may result in loss of funds. Please exercise extreme caution if you intend to participate in these opportunities.

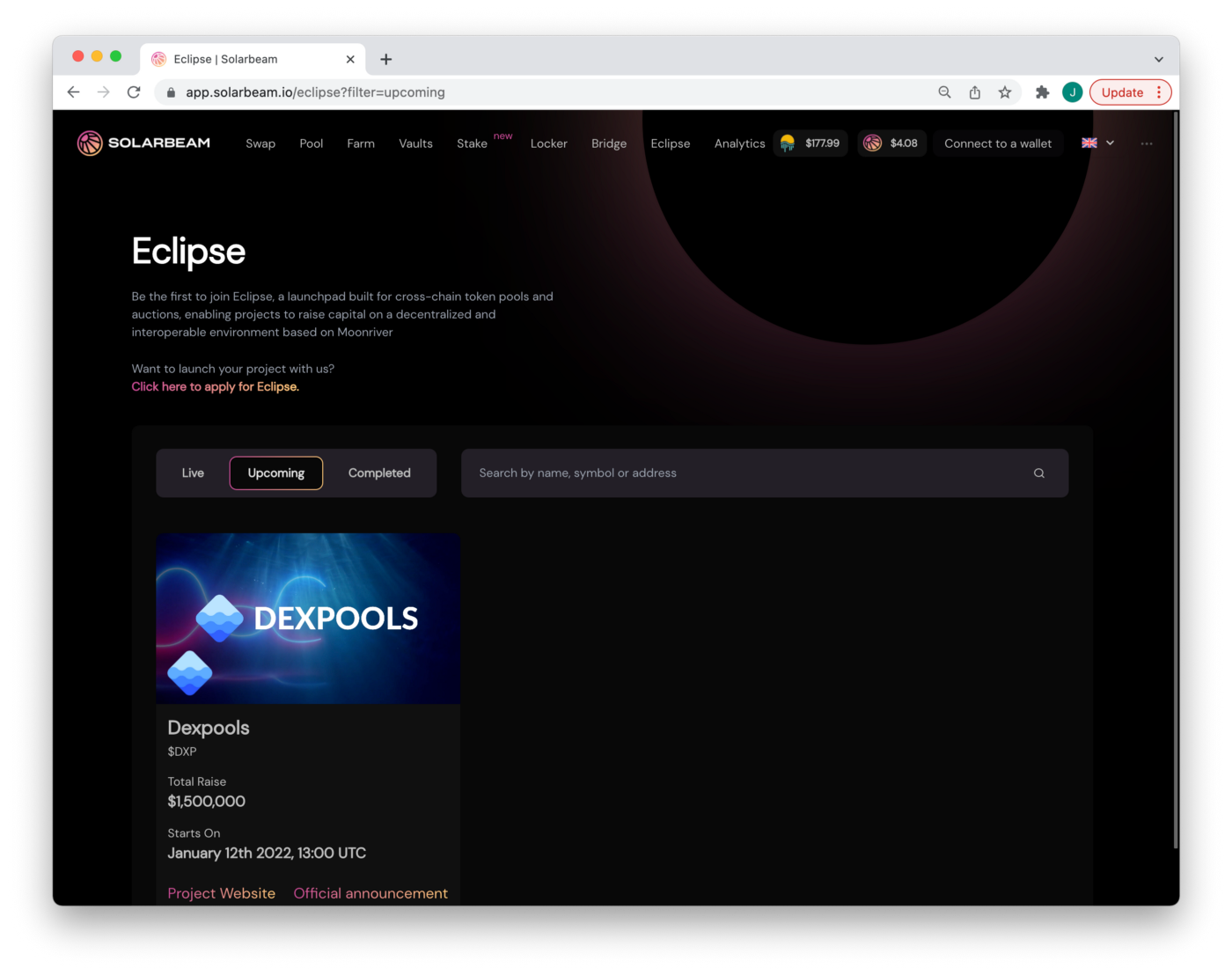

Excitement veiled with several questions has been following the announcement of Solarbeam's new IDO and NFT launchpad - Eclipse.

Solarbeam is the largest DEX on Moonriver's Kusama-based parachain with a peak TVL(Total Value Locked) of more than $180m.

Eclipse is built for cross-chain token pools and auctions. It enables projects to raise capital in a decentralized and interoperable environment based on Moonriver.

But before we deep dive into Solarbeam Eclipse, let us understand what IDOs are.

WHAT ARE IDOs?

IDOs(Initial dex offerings) are one of the many innovative products in the DeFi space. IDOs can be created for anything ranging from cryptocurrencies to music albums.

It refers to launching a cryptocurrency on a decentralized exchange (DEX). In an IDO, a blockchain project makes a coin's first public debut on a DEX to raise retail investors' funding.

Liquidity pools (LP) play an essential role in IDOs by creating liquidity post-sale. A typical IDO lets users lock funds in exchange for new tokens during the token generation event. Some of the raised funds are then added with the new token to an LP before being returned later to the project.

Think of it like a startup - projects issuing IDOs receive financing from individual investors. This is similar to traditional startups receiving venture capital before launching.

But here's the line that differentiates them - investors don't own equity in the project, unlike an initial public offering.

Now you might argue that this sounds eerily familiar to initial exchange offerings (IEOs), where crypto projects launch their tokens and raise funds via a centralized exchange. They both allow immediate trading on top of raising funds.

But here's where IEOs fall short - centralized exchanges come with strict ground rules, including:

Payment of a considerable sum or offering a portion of the tokens to the exchange;

Prohibiting the project from listing their token on competing exchanges;

Having minimal leeway in controlling the parameters of a project's token sale.

And here's how an IDO wins,

It can offer a far more cost-effective token sale and listing model.

An IDO provides quick liquidity with little to no slippage through available liquidity pools in a DEX.

Relatively, it has cheaper listing costs.

And like IEOs, it allows instantaneous trading.

IDOs have even surpassed ICOs as traders' first preference. As of August 2021, based on CoinMarketCap ICO calendar, the past few months of project fundraising are essentially IDOs.

Initial coin offerings(ICOs) are a popular way to raise funds for products and services usually related to cryptocurrency.

ICOs are similar to initial public offerings, but coins issued in an ICO can also benefit a software service or product.

In its essence, an IDO is a successor to ICOs and IEOs as it aims to raise money and bootstrap a project. However, unlike ICOs and IEOs where the tokens are sold before the listing, IDOs are listed immediately on a decentralized exchange (DEX) – hence, the name.

Advantages and Risks of IDOs

I know what you're thinking," We get it, IDOs are a blessing yada yada. But what's the catch?"

We have compared IDOs with other offerings and highlighted their strong points.

Several advantages make IDOs unique, like bringing in investor fairness, lesser fees, instant liquidity, and they're simply more accessible and faster to launch.

But we can't look at everything with rose coloured glasses.

Here are the shortcomings of IDOs,

Greater due diligence on investors

All of this means that it's vital to find trustworthy launchpad platforms that provide anti-scam vetting and Know Your Customer (KYC) checks.

Oversubscription on IDOs

Because IDOs tend to focus on smaller token sales than ICOs did and IEOs do, it's often difficult to participate, as popular projects are often vastly oversubscribed.

To manage this, the launchpad platforms that most IDOs use limit the number of participants with pre-arranged whitelists. These can amount to a lottery or require an investment in launchpad tokens.

The small number of tokens sold with particularly high-profile projects can combine with IDOs' instant liquidity to create rapid price surges and declines.

Solarbeam Eclipse

Now that we have covered IDOs in great detail, it's time to understand how you can participate in an IDO on Solarbeam Eclipse.

Eclipse has been designed to provide a simple, user-friendly experience. All that is required is having 50 SOLAR tokens in the Solarbeam vaults. The vaults have been designed with a dual purpose:

Rewarding long term supporters of Solarbeam with more APR for longer staking periods,

Establishing rank for multipliers in Eclipse.

It's crucial to understand Multipliers before we go ahead.

Multipliers

Based on the amount and the duration of your Solar lock, you'll have a corresponding multiplier.

Depending on which of the two IDO pools you will participate in (basic or unlimited), the multiplier acts differently:

By participating in the basic pool, your multiplier indicates the maximum amount of $ value you are eligible to commit. The maximum commitment in the basic pool is $100 x your multiplier.

E.g. Let's say that you locked 50 Solar for one month in either the vaults or veSolar. Your multiplier is 10x. The maximum amount that you can commit in the basic pool is $1000 worth of Solar/Movr LP ($100 x 10 = $1000).

By participating in the unlimited pool, your multiplier boosts your allocation.

There is no limit in the amount that you can commit in the unlimited pool. There is also a 1% tax used for burns and buybacks.

Someone with a 100x multiplier will get 100 times more allocation from someone with a 1x multiplier in the unlimited pool, even if they committed the same amount of $.

A STEP BY STEP LOOK AT ECLIPSE

New Projects

For each new project, users will have the option of two pools in which they will be able to stake their SOLAR/MOVR LP in order to participate.

During the sale, users will commit their SOLAR/MOVR LP in the pool of their choice to obtain a project's tokens.

After the sale, users will claim the tokens as well as any unspent funds (in case of overflow).

The Eclipse Pools

There will be two pools available for each project:

Basic pool

Users can commit a maximum amount of $100 USD, and this amount can be increased based on their vault multiplier boosts (see multiplier boost table below). There's no fee for participating.

Unlimited pool

Users can commit an unlimited amount of USD worth; their % in the participation will be boosted by their amount of SOLAR in vault and lockup period. There is a 1% participation tax on the overflow for the Unlimited Pool. The tax will be used to buy back and burn SOLAR.

In Eclipse, there isn't a guaranteed allocation. At the end of the IDO, your allocation of the tokens will be calculated based on the amount you committed and the overflow of the pool. Any spare Solar/Movr LP will be refunded at the end of the IDO.

Solarbeam operates on the core values of trust and fairness. They work hard to ensure that all of their projects are fundamentally driven by those core values. This is why Eclipse will allow their users access to projects when they launch but before they go live.

At Solarbeam, we're all equals. The opportunities which were only accessible to VCs and insiders, cutting community members out of early-stage benefits, are now being made accessible to all.

If you wish to launch your project with Solarbeam, Moonriver's most-used AMM project and liquidity provider, they even provide guidance and oversight. Thus ensuring that teams have the resources they need to launch their project successfully.

Bring your token to the most active and rapidly growing community on Moonriver!

NOTE: Please exercise extreme caution if you intend to participate in these opportunities. Happy farming!

In case you haven’t, don’t forget to subscribe to The Bay Journal newsletter to stay up to date with dotsama farms and the happenings in the bay.

Looking to become a sailor?

Follow us on Twitter for updates:

Join us on discord for alpha: