WARP

Liquidity pools are the backbone of decentralized exchanges(DEX). What if I told you that there’s a way you can provide liquidity to any liquidity pool through any token?

Disclosure: This content is for informational purposes only and you should not make decisions based solely on it. This is not investment advice. Please exercise extreme caution if you intend to participate in these opportunities.

UPDATE

WARP is all set to launch in a limited alpha phase on 29th April 2022. Find more info on our Twitter and Discord.

Liquidity Pools

Before we move any further, let’s understand liquidity pools.

Liquidity pools are reserves of tokens secured in smart contracts. Its main goal is to facilitate trades between two tokens.

And how do they work exactly?

Our sailors, liquidity providers(LP) in this case, need to add an equal value of two tokens in a pool to create a market.

The biggest attraction of liquidity pools is the absence of an intermediary that executes trades.

Traders can get in and out of positions on token pairs that likely would be highly illiquid on order book exchanges.

And why do these providers stake their tokens?

For amazing returns which are expressed as an APY(Annual Percentage Yield). In exchange for providing their funds, they earn trading fees from the trades that happen in their pool, proportional to their share of the total liquidity.

You can never lose your initial amount if you pick the correct pools, even in market dips. When a market dips, people panic, sell and swap their tokens for other tokens, and the more the transactions are made across the pool, the more you earn.

But what’s the catch?

The biggest hassle is you have to split the principal amount into two equal value tokens to be a liquidity provider.

It is done to ensure that both tokens in the pool are in the same ratio or close to the same ratio. This is required by the x*y=k algorithm used by most Uniswap style pools.

But the values of tokens vary like tides in the sea!

Let's consider you want to be a liquidity provider. You would need to ensure that you have the tokens you wish to provide in an equal ratio of value, which is subject to market change.

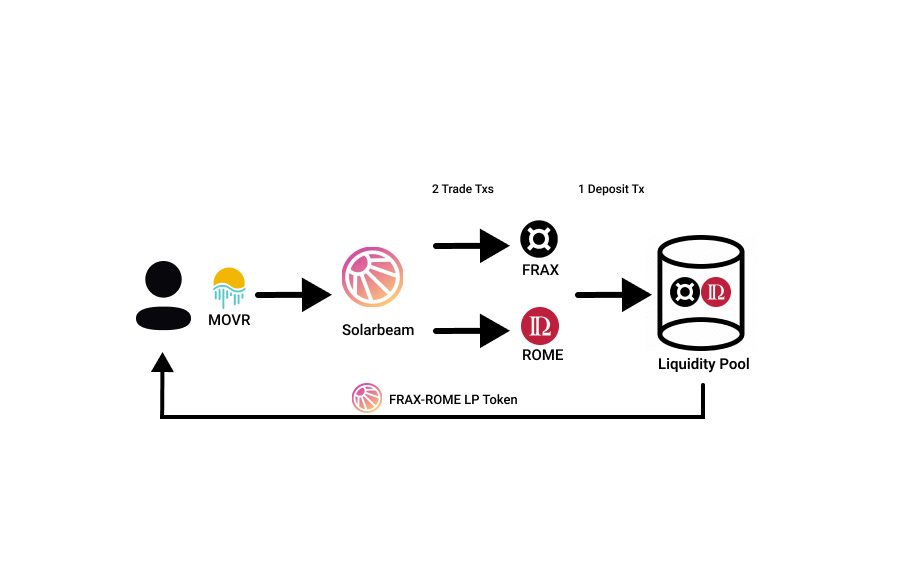

To give an example, say you want to farm the FRAX-ROME and you only have 20 MOVR in your wallet. You would need to swap some MOVR tokens to get an equal proportion of FRAX and ROME.

And not to forget, you'll need to pay gas for swapping tokens all while accounting for market change.

An unnecessarily long drawn out process.

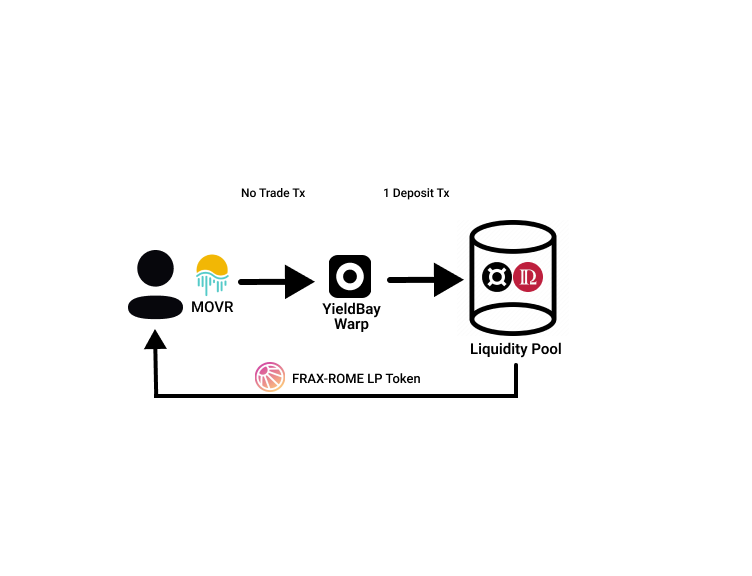

And that’s exactly why here at the Bay we created Warp, as a solution for the above problem - the 50-50 problem.

You connect your wallet at YieldBay and move through the Warp by just pressing a button, and a smart contract enables swaps your tokens for you and sends them to liquidity pool smart contract.

You won't have to convert the funds yourself and balance the change, which is market-dependent.

You have to press a button, and our smart contract will take it from there!

How does Warp work?

You tell our smart contract what token you want to invest and which liquidity pool you want.

Then, the smart contract takes your tokens and talks to the Solarbeam smart contracts to deposit your token in the pool.

The smart contract splits the token you want to invest into two halves. Then, by interacting with the Solarbeam DEX Router, it converts the halves to the two tokens needed to provide liquidity.

Once the smart contract has the two tokens needed to provide liquidity for your chosen pool, it puts them into the pool and transfers to you, the user, the LP tokens that it receives in return for providing liquidity using your token.

Warp-In lets you provide liquidity to a pool from one token, and this one token can be any token.

Warp-Out lets you remove liquidity from a pool and receive the removed liquidity in either one of the tokens present in the pool or MOVR.

In case you haven’t, don’t forget to subscribe to The Bay Journal newsletter to stay up to date with dotsama farms and the happenings in the bay.

Looking to become a sailor?

Follow us on Twitter for updates:

Join us on discord for alpha: