Everything you need to know about stablecoins

Stablecoins have gained traction as they attempt to offer the best of both worlds- the near instant settlement and security of cryptocurrencies, and the stable valuations of fiat currencies

Disclosure: This content is for informational purposes only, and you should not make decisions based solely on it. This is not investment advice. Please exercise extreme caution if you intend to participate in any listed opportunity.

A stablecoin is a cryptocurrency pegged to a stable reserve asset like a fiat currency, commodity, or other cryptocurrencies. It is a tokenized version of the asset and can be introduced subtly into a blockchain ecosystem to facilitate seamless transactions, improved arbitrage, and value exchange.

The combination of traditional-asset stability with digital-asset flexibility has proven to be a wildly popular idea.

Why are stablecoins so important?

A currency should act as a medium of monetary exchange and a mode of storage of monetary value, and its value should remain relatively stable over longer time horizons. Users will refrain from adopting it if they are not sure of its purchasing power tomorrow.

Some expect the same behavior from cryptocurrencies. They should maintain their purchasing power and have the lowest possible inflation.

Stablecoins are very appealing to conservative investors who dislike the volatility of the cryptocurrency market as it allows them to hedge the risk of their portfolio.

Stablecoins achieve their price stability via collateralization (backing) or through algorithmic mechanisms of buying and selling the reference asset or its derivatives.

They have managed to inherit some of the most powerful properties of non-pegged cryptocurrencies while minimizing volatility. For example, they are -

open, global, and accessible to anyone on the internet, 24/7

fast, cheap, and secure to transmit

digitally native to the Internet and programmable

What are the different types of stablecoins?

There are essentially four types of stablecoins differentiated on the basis of three major criteria:

is there an issuer/custodian responsible for satisfying any attached claim;

how decentralized is decision-making over the stablecoin;

the underlying value of the stablecoin and its stability in the currency of reference.

Fiat-backed stablecoin:

The value of these stablecoins is pegged to the collateral that backs them.

For example, if a stablecoin is backed by a fiat currency, say the US dollar, it means every stablecoin is equal to $1. Hence, if the issuer of the stablecoin has $3 million in reserve, they can only issue three million stablecoins in exchange for it.

Tether is an example of a fiat-backed stablecoin.

They maintain a fiat currency reserve, like the U.S. dollar, as collateral to issue a suitable number of crypto coins.

Such reserves are maintained by independent custodians and are regularly audited for adherence to the necessary compliance.

Crypto-backed or on-chain stablecoins:

These coins are backed by another asset, typically other cryptocurrencies. The value of the stablecoin is securely pegged using other cryptocurrencies as collateral.

These crypto-backed stablecoins use smart contracts and do not need an issuer or central custodian.

Dai is an example of an on-chain stablecoin backed by multiple collaterals such as YFI, ETH, UNI, WBTC etc.

Because the reserve cryptocurrency may also be prone to high volatility, such stablecoins are over-collateralized—that is, a larger number of cryptocurrency tokens is maintained as a reserve for issuing a lower number of stablecoins.

Securities/commodity-backed or off-chain stablecoins:

These stablecoins are backed by other traditional assets such as securities or commodities. They can be collateralized against precious metals like gold, oils, or real estate.

Investors can also redeem their investment and get physical delivery of the collateral. Therefore, there is a need for a custodian.

However, token redemption is only possible for set measurements of the collateral.

For example, many issuers only deliver gold bars when you redeem a stablecoin backed by gold. Hence, if one token of the stablecoin is equal to one gram of gold, the number of stablecoins units required would be in proportion to the weight of the gold bar.

Gold is a popular collateralized commodity.

Tether Gold (XAUT) and Paxos Gold (PAXG) are among the most liquid gold-backed stablecoins.

Algorithmic stablecoin:

An algorithmic stablecoin is not backed by any collateral.

But, it uses a special algorithm to maintain the prices of the coin. If the price of the stablecoins falls below the price of the fiat currency it tracks, the algorithm reduces the number of tokens in circulation.

While, if the prices of the stablecoin rise above the fiat currency it tracks, the algorithm increases the number of tokens in circulation to accordingly adjust the value of the stablecoin.

It does not need any custodian for the underlying asset and operations are totally decentralized.

NuBits is one such algorithmic stablecoin that has been around since 2014.

Such actions are similar to a central bank buying or printing banknotes to maintain valuations of the fiat currency.

Why are stablecoin interest rates so high?

You must be wondering how a stablecoin worth a dollar would command the same interest rate as a dollar, namely zero. But a quick search of lending rates on stablecoins reveals rates of anything from 6 - 9%, or even more.

The straightforward explanation is that high-interest rates compensate people for the risk that the stablecoin will fall off its peg.

But there is another reason too.

Demand for stablecoins constantly exceeds supply. So people with stablecoins to lend can charge premium interest rates, and crypto platforms desperate for stablecoins offer high-interest rates to attract new stablecoin lenders.

Where is all this demand coming from?

The most obvious guess is Exchanges. Stablecoins make great liquidity for crypto exchanges. They enable people to trade in and out of cryptocurrencies easily and quickly without risking losses on the bridging asset. As crypto trading increases, so, too, does demand for stablecoins.

Stablecoins also provide crypto investors with a “safe haven” when cryptocurrency price volatility is high. So when cryptocurrencies go on a wild roller-coaster ride, as they have in recent months, demand for stablecoins rises.

This tends to push them off their pegs, which rather destroys their purpose. So when people are cashing out of risky crypto into nice, safe stablecoins and stablecoins start looking expensive, the price stability mechanism of stablecoin protocols kicks in.

In this respect, stablecoin issuers are not like central banks.

Central banks aim to control interest rates. Stablecoin issuers only control exchange rates.

But it’s not the only reason. There’s an insatiable demand for stablecoins – and it doesn’t just come from exchanges.

It comes from decentralized finance.

Dollar-pegged stablecoins are used in DeFi lending and staking pools. As more and more people dip their toes into DeFi and more and more new platforms appear, demand for stablecoins is rising exponentially.

In December, research by The Block revealed that stablecoin issuance had risen by 388% in a year, mainly driven by demand from DeFi. If this trend continues, demand for stablecoins as collateral may outstrip the use of stablecoins as safe assets on exchanges.

Conclusion

Stablecoins’ attempt to bridge this gap between fiat currencies and cryptocurrencies have been highly successful.

They do still come under scrutiny by regulators but no one can deny the impact they’ve had.

Stablecoins are an incredible gateway for those who are interested in dipping their toe in the crypto space but don’t want to go all-in on the more volatile coins in the space.

Also, don’t forget to check out aUSD, Polkadot’s native stablecoin launched by Acala.

aUSD is the core of Acala’s DeFi ecosystem and will serve as the stablecoin powering the Polkadot and Kusama ecosystem.

Some stabelcoin yield-farming opportunities in the dotsama ecosystem:

Moonwell

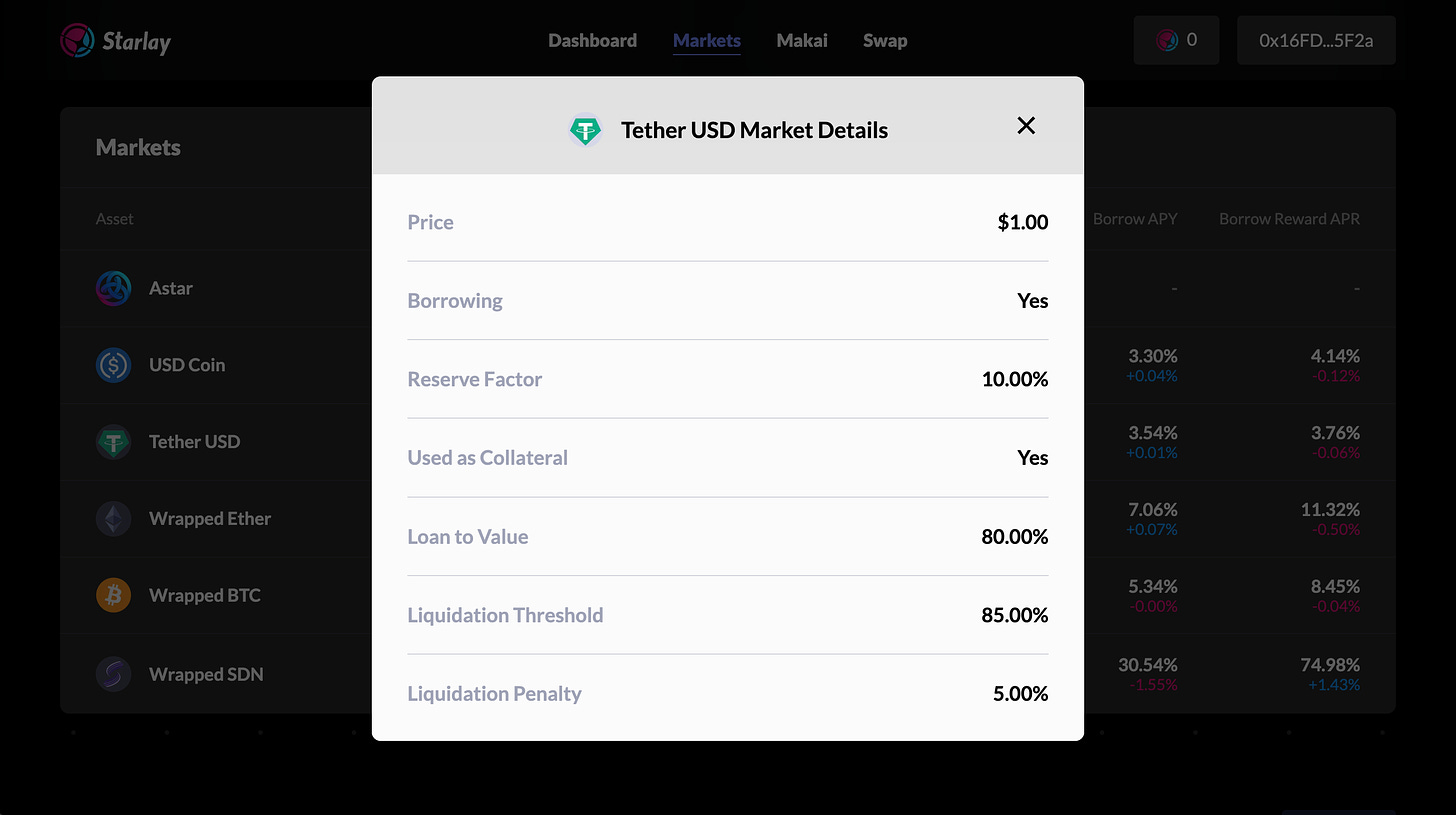

Starlay Finance

Solarbeam

3pool(USDC+BUSD+USDT) - TVL $1,386,835, 7.88% APR

Huckleberry Finance

In case you haven’t, don’t forget to subscribe to The Bay Journal newsletter to stay up to date with dotsama farms and the happenings in the bay.

Looking to become a sailor?

Follow us on Twitter for updates:

Join us on discord for alpha: